We provide some sample letters to CRA below. If you are a Canadian citizen or resident, chances are you will have to write a letter to the Canada Revenue Agency (CRA) at some point in time. Whether it is to inquire about a tax issue, request a refund or provide additional information, it is important to format and write your letter in a clear and concise manner.

Here are some tips and examples of how to format and write a letter to the CRA:

- Use a professional tone: Your letter should be written in a formal and respectful tone. Avoid using slang or informal language, and address the recipient as “Dear Sir/Madam” or “To Whom It May Concern.”

- Include your contact information: Make sure to include your full name, address, and phone number at the top of the letter, along with your Social Insurance Number (SIN) or Business Number (BN) if applicable.

- State the purpose of your letter: Clearly state the reason why you are writing to the CRA. Be specific and concise, and include any relevant dates or reference numbers.

- Provide supporting documents: If you are writing to the CRA to provide additional information or documentation, make sure to include copies of any relevant documents. It is important to keep the originals for your records.

- Be polite and courteous: It is important to maintain a polite and courteous tone throughout your letter. Avoid making any accusations or using inflammatory language, as this can harm your relationship with the CRA and may even lead to further problems.

- Use proper formatting: Your letter should be formatted in a professional manner, with proper margins, spacing, and font size. Use a standard font such as Times New Roman or Arial, and make sure the letter is easy to read.

- Proofread your letter: Before sending your letter to the CRA, make sure to proofread it carefully for any spelling or grammatical errors. A poorly written or formatted letter can reflect negatively on your professionalism and may harm your chances of resolving your issue with the CRA.

Sample of letter to CRA for change of year-end

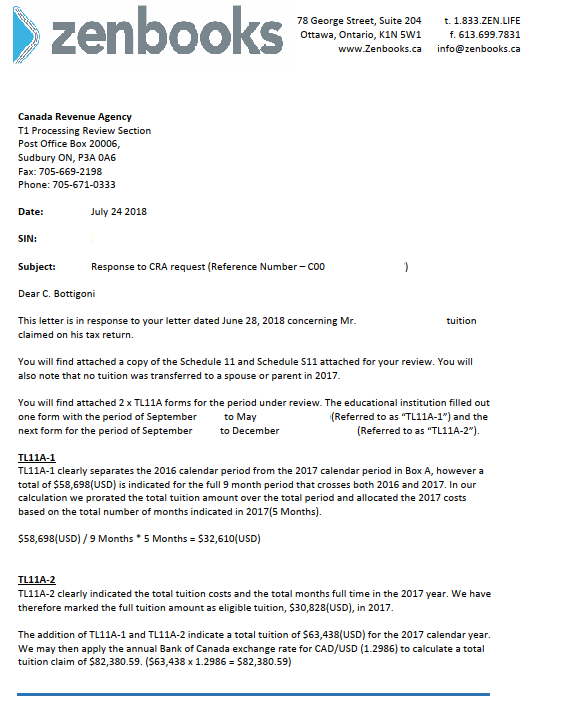

Sample of letter to CRA for response to tuition review/audit