Scope and Cost of Audit Representation: Clarifying What “Audit Protection” Entails and Its Cost

Scope and Cost of Audit Representation: Clarifying What “Audit Protection” Entails and Its Cost

At Zenbooks, peace of mind isn’t a slogan. It’s our promise. When you entrust us with your taxes, you gain more than compliance. You gain clarity, responsiveness, and critical protection. This post explains what “audit representation” really means, what “audit protection” covers, and how much it costs (and doesn’t cost) when we bundle in AuditShield.

1. Executive Summary

In plain language, “audit representation” means having a capable tax team handle any official review or audit by the Canada Revenue Agency (CRA) on your behalf. “Audit protection” means you pay a fixed fee (or it’s included) and our team manages the process, so you don’t face surprise professional bills when you get the audit notice.

At Zenbooks, when you subscribe to our “Enlightened Tax Package,” audit representation is included. That means you sleep easy, we respond to CRA, and you don’t pay extra for representation fees.

2. What “Audit Representation” Actually Includes, Step by Step

Audit representation isn’t just showing up because CRA sends a letter. It involves:

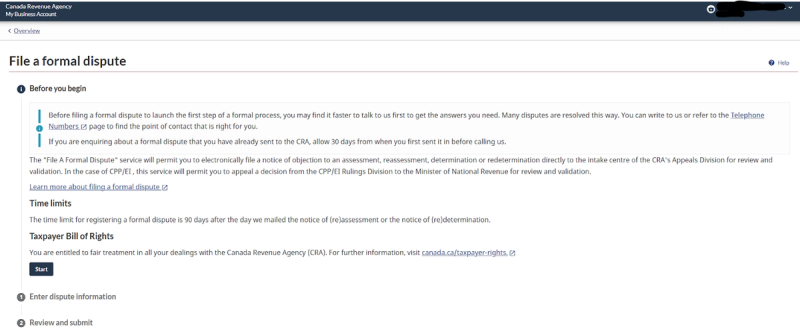

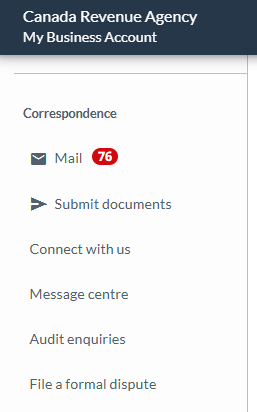

- Receiving and interpreting the CRA correspondence (which could be a simple review, partial audit, or full field audit).

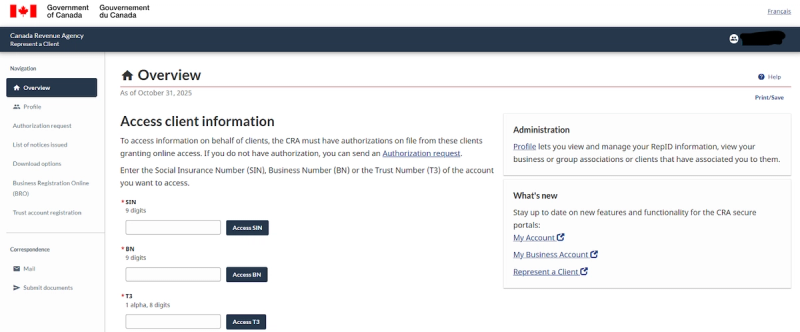

- Securing proper authorization (e.g., T1013, representative authorization) so our team can deal directly with CRA.

- Gathering and reviewing your documentation: receipts, contracts, ledgers, reconciliations, employment records, etc.

- Building a response file: letters of explanation, summary of positions, any computations or schedules CRA has asked for.

- Submitting the documents and correspondence to CRA, tracking timelines, and responding to additional queries.

- Meeting with CRA (if required), either virtually or in person, representing your interests.

- Negotiate or clarify CRA’s proposed adjustments (if there are any).

- Providing a post-audit debrief: summarizing outcomes, updating your records, and adjusting your planning accordingly.

In short, your tax team does the heavy lifting so you can keep running your business. CRA outlines the audit process and your rights.

3. What “Audit Protection” Means and What It Does Not

“Audit protection” often means that you are covered (via a fee-waiver service or insurance-backed model) for the professional fees your accountant or tax advisor charges to respond to an audit or review.

What it usually does not cover: the tax, interest, or penalties that may result from an audit adjustment. For example, if CRA disallows a deduction and assesses extra tax plus interest, you still owe that tax and interest. Audit protection covers the representation fees, not the tax itself.

For example, the AuditShield offering states that it “covers the professional fees … incurred as a result of an official audit, enquiry, investigation or review of filed returns with the Canada Revenue Agency (CRA) or other provincial authorities.”

It also means you don’t have to worry about how many hours the audit response will take; you’re not negotiating hourly billing after the fact. You’ve already fixed or included the representation cost, giving you rare predictability in tax engagements.

4. Why Zenbooks Uses AuditShield and Bundles It in the “Enlightened Tax Package”

At Zenbooks, we believe that accounting and tax should deliver calm clarity, not anxiety. The tax-audit world is volatile, especially with the CRA’s increasing review activity. Rather than clients stumbling through surprise bills or struggling with unknown exposure, we say: make audit representation part of the offer, not an add-on.

By using AuditShield and bundling it into our tax solution. We do this because:

- The CRA picks filers for review or audit, not just when there’s a mistake. Even accurate returns can trigger scrutiny.

- When you know representation is included, you act sooner, respond faster, and reduce the risk of escalation.

- It aligns with our brand promise: you relax, we handle it. Instead of a surprise invoice after the fact, you budget once and shift your attention back to your business.

5. How Often Do CRA Audits and Reviews Happen, Really?

It’s impossible to predict who will be audited, but a few key points help set context:

- The CRA states that audits, reviews and enforcement actions are part of its mandate to ensure correct self-assessment.

- Some industry commentary estimates that around 1% (or more, depending on industry) of returns may face some audit or review.

- Importantly, the audit trigger isn’t always because of a mistake. One firm notes that “just because your returns are prepared accurately and on time, you could still be selected.”

Given this, even if the probability of a full-field audit seems low, the cost of being selected can be substantial. That’s why representation matters. New business owners don’t always understand this, but experienced ones value the protection.

6. The Cost Side: What Audit Representation Typically Costs Without Protection

Let’s be realistic about cost. Without audit protection, you could incur:

- Document-gathering: 5-15 hours, depending on business complexity

- Correspondence with CRA: multiple rounds of letter requests, follow-ups, clarifications

- Meeting time: if a CRA auditor visits or has a conference call

- Objection phase: if CRA proposes an adjustment and you decide to challenge it

- Senior partner review time (to ensure risk is managed)

Typical Canadian CPA hourly rates for complex tax-audit representation can range from $250-$450/hour (or higher), depending on region and complexity. (Psssttt…Our rates are similar at Zenbooks)

Sample cost scenarios (without protection):

- A desk review of personal tax return: 8 hours × $300/hr = ~$2,400

- A GST/HST review of a small service business: 20 hours × $325/hr = ~$6,500

- A payroll compliance audit for a company with contractors/employees: 30 hours × $350/hr = ~$10,500

And that’s just for representation fees! If CRA finds an adjustment, you still have tax, penalties and interest exposure. The unpredictability of cost is what causes most business owners anxiety.

7. How AuditShield Pricing Works and What It Typically Covers

AuditShield works under a “fee-waiver service” or insurance-backed model: you pay an annual fee (deductible for businesses), and if you are selected for an audit or review, your representation costs are covered. Key features:

- Covers corporate tax, personal tax, GST/HST, employer payroll compliance reviews, and business audits.

- The annual fee is based on business size, revenue and risk profile (not on how many hours you will need).

- The fee is tax-deductible for businesses.

- No hourly billing surprises for audit representation. You’ve prepaid for “peace of mind”.

- Coverage often starts the day after payment and applies to any notices received during the coverage period.

At Zenbooks, we include this (via AuditShield) as part of the Enlightened Tax Package.

8. Three Client Scenarios with Transparent Math

To bring this into real-world focus, here are three scenarios we commonly see, showing representation cost WITHOUT protection vs cost WITH AuditShield via Zenbooks.

Scenario A: Desk Review – Personal Return with Employment Expense Claim

Situation: A sole proprietor of a small consulting firm claims home-office, vehicle and other employment expense deductions. CRA sends a letter requesting backup for employment expense claims.

- Without protection: 6 hours of work at $300/hr = $1,800

- With AuditShield included via Zenbooks: $0 incremental. Representation covered Outcome: Owner focused on business growth, avoided surprise fees.

Scenario B: GST/HST Targeted Review – Service Business

Situation: A marketing agency with ~$750K revenue sees a CRA review of GST/HST input tax credits and revenue reporting. Documents requested include sales details, input credit substantiation, contracts, and billing.

- Without protection: 18 hours × $325/hr = ~$5,850

- With Zenbooks AuditShield: $0 incremental for representation (tax outcomes still possible) Outcome: Agency stays on track, doesn’t pause marketing to deal with billing worry.

Scenario C: Employer Payroll Compliance Review – Contractor vs Employee

Situation: A non-profit with 12 staff plus 4 contractors is visited by a CRA payroll audit. Focus areas: T4A vs T4 classification, taxable benefits, contractor expense eligibility. Work involves data extraction, reclassification, meetings, and statements. (Also see how to manage employees vs contractors here)

- Without protection: 30 hours × $350/hr = ~$10,500

- With Zenbooks AuditShield: representation cost is covered Outcome: Business focuses on strategic growth, not firefighting.

In each case, the representation cost is removed when you’ve chosen the package that includes audit protection. That difference, from thousands of dollars of billable hours to zero extra fee, is what makes audit protection a compelling part of a modern tax offering.

9. Where Audit Representation Ends – and Legal or Litigation Work Begins

It’s important to be clear: representation via your tax team covers audits, enquiries and reviews by CRA. When tax counsel or litigation is involved (for example, full court proceedings, appeals beyond CRA objection, or multi-jurisdictional litigation), then additional specialist legal costs may apply. AuditShield representation coverage may include some expert or legal fees, depending on policy, but typically within certain limits. At Zenbooks, we coordinate with tax lawyers when that boundary is reached; you’re still managed by us, but specialist work is engaged accordingly.

10. How Zenbooks Orchestrates Your Defence and Documentation

When you work with Zenbooks, you’re getting more than “someone will call CRA”. You’re getting a process:

- Secure client portal for documentation upload and versioning

- Proactive checklist at the start of your engagement, so we keep your files audit-ready

- Scheduled bi-annual tax check-ins (part of our enlightened tax services) and email access year-round.

- If an audit or review starts, we trigger our audit workflow, allocate the team, manage the timeline and keep you informed

- Final debrief and plan adjustment: we don’t just close the file, we update your tax plan so you’re stronger next time

That orchestration is precisely the “peace of mind” we pledge: you don’t have to scramble when CRA knocks.

Category

Without Audit Protection

With Audit Protection (AuditShield via Zenbooks)

Response to CRA Audits or Reviews

You must hire and pay your accountant’s hourly fees (typically $250–$450/hour).

Zenbooks’ team manages the entire process at no additional cost beyond your package.

Included Services

Representation is billed hourly: correspondence with CRA, document gathering, meetings, and appeals.

Full audit representation included: CRA correspondence, documentation, negotiation, and post-audit follow-up.

Predictability of Cost

Highly variable: depends on audit scope and duration. Can range from $2,400–$10,500+.

Fixed and predictable: coverage included in your annual tax package. No surprise fees.

Financial Impact

Unexpected bills and potential cash flow strain during stressful periods.

Peace of mind knowing representation fees are covered. Focus remains on your business.

Tax, Penalties, and Interest

You’re responsible for both representation costs and any additional taxes or penalties assessed.

You’re still responsible for any CRA-assessed tax, penalties, or interest, but not for representation costs.

Timing of Coverage

Can’t buy protection after receiving a CRA letter. Must pay fees once audit starts.

Coverage active throughout the policy term; Zenbooks handles any audit notices received during that time.

Eligibility

Pay-as-you-go: you incur costs only when selected for audit.

Automatic protection included in Zenbooks’ Enlightened Tax Package.

Business Continuity

You must divert time and resources to handle CRA requests.

Zenbooks manages communication and documentation, so you can stay focused on operations.

Emotional Cost

Stress, uncertainty, and time lost managing correspondence.

Confidence and calm: Zenbooks’ team responds directly to CRA.

Best Fit For

Very simple personal tax returns (T4 only, no business, no HST).

Business owners, incorporated professionals, and anyone filing complex or multi-entity returns.

11. FAQs Owners Ask About Audit Protection and Cost

Does audit protection cover additional tax, penalties or interest?

Can I buy audit protection after I receive a CRA letter?

What if my prior accountant filed the return, and I switch to Zenbooks?

How long does coverage last?

What if CRA opens multiple reviews in a year?

12. When Audit Protection Is a No-Brainer and When It Might Be Optional

If you’re incorporated (or running a sizable sole-proprietorship), registered for GST/HST, claim significant deductions (home-office, vehicle, contractors) or have payroll > 1 employee, then audit protection is a no-brainer. The cost of representation may be thousands. Paying a known annual fee is simply smarter.

On the flip side, if you have a very simple personal tax return (T4 income only, no business, no HST, no investments), your risk is lower and representation cost may be minimal. In that scenario, you can choose to decline protection, but you do so knowingly.

At Zenbooks, we believe the best path is inclusion: you sleep easier.

13. Let Us Handle the Unknown, So You Focus on Growth

If you want to shift your focus away from “What if CRA comes?” and back to “How do we grow?” book a complimentary consultation with Zenbooks. Let us walk you through your tax strategy, show you how audit protection is built in, and help you compare how this integrated approach saves time, cost and worry. Visit our Tax Services page, check our Pricing page, and schedule your call. With Zenbooks, everything will be fine.

We’re Zenbooks, a remote finance team that believes financial management is more than just numbers on a page. Learn more about the clarity, simplicity, and peace of mind we offer business owners through our innovative solutions and personalized service.

Subscribe for Updates

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.