10 Common Bookkeeping Mistakes and How to Avoid Them

Clarity Creates Confidence

You started your business because you love what you do. The last thing you signed up for was wrestling with receipts, reconciling bank statements, or scrambling at year-end to make sense of your books. Yet for many small business owners, bookkeeping becomes one of the biggest sources of stress, wasted time, and cost.

At Zenbooks, we believe that good bookkeeping is more than a necessary evil. It’s a foundation for growth, smart decisions, and peace of mind. With the right habits and systems, you can move from reactive (catching up) to proactive (seeing ahead). And that starts with identifying the most common bookkeeping mistakes (and knowing how to fix them).

Here are 10 of the most common bookkeeping mistakes we see in the field, along with practical solutions to avoid them. If you’d prefer to partner with a team that handles the bookkeeping, accounting and advisory for you, we’ve been doing it for hundreds of small to mid-sized businesses across Canada and beyond(and for non profits too!). For instance, our client Menos grew from under $200 K to over $12 M with our help.

Let’s dive in.

Mistake #1: Mixing Personal and Business Expenses

What goes wrong: When you use the same bank or credit card for personal and business transactions, you muddy your records. It becomes difficult to determine business profitability, prepare tax-deductible expenses or reconcile with your bank.

Real-world example: We’ve seen a freelancer use one credit card for both home groceries and client supplies, making year-end categorization a headache. What usually happens is his misses deducting his legitimate business expenses or spends enormous amount of time trying to split them up at year-end.

Solution:

- Open a dedicated business bank account and business credit card.(It’s worth those nifty bank fees)

- If you must use personal funds, immediately record a reimbursement or owner’s draw, clearly labelled.

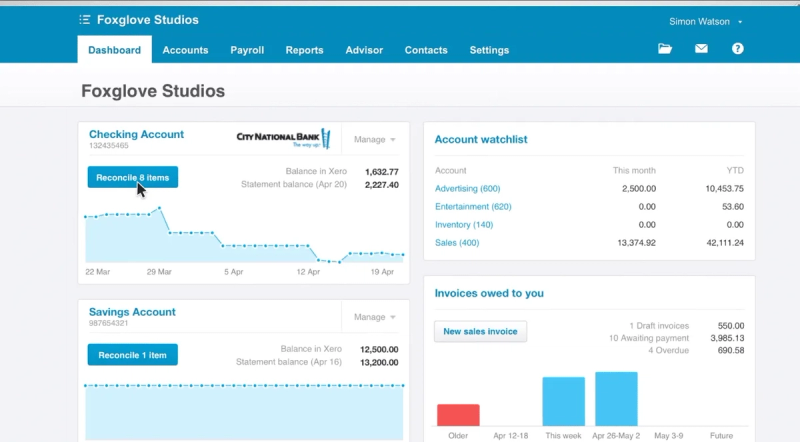

- Automate categorization in your accounting software (e.g., Xero or QuickBooks Online) so that business vs personal is flagged.

By keeping personal and business separate, you’ll have accurate profit margins, simplified tax prep, and minimal audit risk. Otherwise your bookkeeping fees go up and your headaches multiply!

Mistake #2: Poor Record-Keeping

What goes wrong: Missing receipts, scattered spreadsheets, ad-hoc filing systems. If your records are fragmented, you’ll waste time every month trying to reconstruct transactions.

Example: We had a service business store receipts in a physical shoebox(Yep, people do that!) and enter transactions only when prompted by the accountant.

Solution:

- Adopt a weekly digitization habit: scan or photo receipts. Send them to your Dext, Expensify or HubDoc(Yes, they still exist) account.

- Use tools like Dext, Hubdoc, Expensify for automated document collection. Zenbooks’ client Somerset Health & Wellness Centre reported “it’s very rare nowadays that we lose track of a document.”

- Set a fixed time each week (e.g., Thursdays 4 p.m.) to review, categorize, and file.

When records are timely and organized, month-end closes faster, insights are more reliable, and tax time is far less painful.

Mistake #3: Not Reconciling Accounts Regularly

What goes wrong: If you allow your bank, credit card, or payment-gateway transactions to pile up, you lose track of errors, duplicate entries, unrecorded fees or missed income.

Solution:

- Reconcile all bank and credit card accounts at least once per month(often weekly).

- Match payment gateway feeds (e.g., Shopify, PayPal, Stripe) to accounting entries so nothing slips.

- Maintain a short checklist: (1) large unusual transactions (2) supplier credits (3) fees/charges.

For example, one of our clients, Moniker Partners (a corporate travel & retreat planning business) had issues with deferred revenue and foreign-exchange transactions because the previous firm ignored reconciling monthly. With our monthly review + advisory, they hit consistent closes and predictable cashflow. They 4x Revenue from $5M to $20M per year after that.

Mistake #4: Forgetting to Track Sales Taxes (GST/HST/QST)

What goes wrong: Many small Canadian businesses overlook registration thresholds, mix taxable/nontaxable transactions, or mis-allocate sales tax paid vs collected. The result: unexpected tax bills, penalties, or misuse of input tax credits.

Solution:

- Know your registration triggers (e.g., $30 000 within 4 quarter-periods).

- Use accounting software that tracks tax rates automatically, segregates taxable vs exempt sales.

- Schedule a mid-year tax check (as Zenbooks offers in its packages) to ensure you’re not under- or over-collecting.

Avoiding this mistake saves time, avoids fines, and ensures you’re capturing all eligible credits.

Mistake #5: Ignoring Accounts Receivable

What goes wrong: You deliver your service or product, issue an invoice… and then forget to follow up. Unpaid invoices hurt cash flow and distort profitability.

Solution:

- Set clear payment terms (e.g., Net 0, 15 or 30 days) and issue invoices promptly.

- Automate reminder emails (Xero has this built in).

- Include an AR ageing report monthly. Review with your accountant or advisor and flag overdue accounts.

When you monitor receivables systematically, you improve cash-flow and reduce stress.

Mistake #6: Misclassifying Expenses

What goes wrong: A common example: categorizing “software subscriptions” under “office supplies” rather than “software & SaaS.” This mis-classification clouds your finance reports and may reduce your tax deductions or skew your profitability analysis. Especially when it changes year over year.

Solution:

- Create a well-defined Chart of Accounts tailored to your business.

- Use monthly bookkeeping reviews (a service we emphasise at Zenbooks) to catch and correct mis-codes.

- When new expense types emerge (e.g., virtual events, subscriptions), immediately add new categories rather than stuffing into “miscellaneous.”

- Be even more mindful of meals, entertainment, gift cards, employees gifts because there are serious tax implications.

Correct classification means more meaningful P&L statements, clearer decision-making, and better strategic insight.

Mistake #7: Not Backing Up Financial Data

What goes wrong: If your bookkeeping is largely offline (desktop software), stored only on one computer, or relies on one person’s memory, you risk data loss, version control issues, or absence of audit trail. Thankfully our research from the 2023 Zenbooks Technology in Accounting Report shows that only 18% are NOT on cloud accounting software(so most are fine now).

Solution:

- Move to a cloud-based accounting system (e.g., Xero and QBO) which backs up automatically.

- Ensure your remote team uses secure access, two-factor authentication, and has disaster-recovery protocols.

- Maintain a documented workflow: who uploads receipts, who checks entries, who archives documents.

By ensuring safe, backed-up data you avoid surprises, protect your business continuity, and preserve audit-ready records.

Mistake #8: DIY Bookkeeping Without Oversight

What goes wrong: Doing the bookkeeping yourself might seem cost-effective, but without periodic oversight, errors accumulate. Many business owners are operationally excellent, but not trained accountants. The data entry is easy(even automated), but the bookkeeping, reporting and insights is the valuable part of the service.

Solution:

- If you handle books in-house or maintain spreadsheets, schedule a monthly review with an external advisor.

- At Zenbooks we offer monthly review and controller-level oversight so you don’t just “get the numbers”, you understand them.

- Use that review meeting to ask two questions: (1) What surprised you this month? (2) What decisions will you take next month because of the numbers?

This mistake is costly because small errors compound. Missed revenue, unreported expenses, and lost opportunities add up and compound month over month.

Mistake #9: Failing to Plan for Taxes

What goes wrong: Because taxes happen annually (or quarterly), many business owners behave like they have “free cash” until they suddenly owe a large amount to the tax authorities. Then they scramble or borrow.

Solution:

- Determine estimated tax liabilities (income tax + HST + payroll) each quarter.

- Set up a dedicated tax-savings account and transfer a percentage of profits each period.

- Ask yourself “How can I reduce my tax liability?”

By treating taxes as an integral part of your cash-flow planning, you stay ahead, not behind.

Mistake #10: Not Understanding Financial Reports

What goes wrong: Many business owners glance at revenue only. They don’t look at the balance sheet, cash-flow statement or key ratios. Without understanding what the numbers mean, you’re flying blind.

Solution:

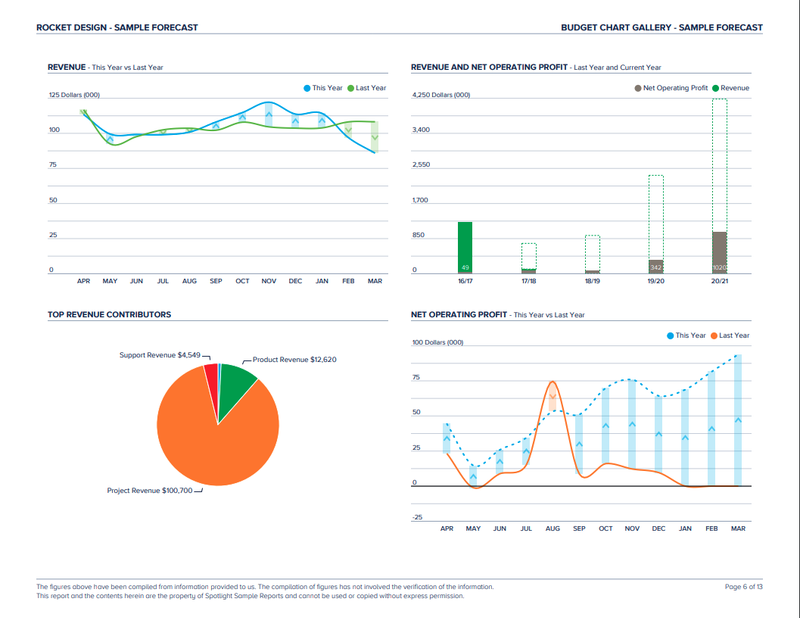

- Demand a monthly dashboard that includes: revenue vs budget, gross margin, accounts receivable days, accounts payable days, cash runway.

- Spend 15 minutes reviewing the report monthly, identifying one “insight” and one “action” for the business.

- If reading financials is not your strength, partner with a Virtual CFO. For example, Zenbooks helped Menos scale from $156 K to $12M in revenue by providing cross-border tax and CFO-level strategy plus monthly real-time reporting.

This mistake is strategic in nature. If you don’t use your numbers, you cannot steer your business.

Using the Wrong Tools for Your Business

It’s not just about habits (That’s a big part of it). It’s also about platforms. Many small businesses try to shoehorn spreadsheets, desktop software, or generic tools when they need scalable cloud-solutions.

Toolset tips:

- Use Xero/Quickbooks (cloud accounting) + Dext/Hubdoc (automated document capture) + Plooto (payments) + Wise (international transfers) if you handle cross-border.

- Review your tech stack annually. What worked when you were $500K revenue may not cut it at $5M.

- At Zenbooks we studied the “Technology in Accounting” trend with Abacus Data and found that 82% of growth-oriented businesses are using digital accounting; those that stick with analog methods have stagnation.

Choosing the right tools means fewer manual errors, faster closes, and better insight.

Turning Bookkeeping from a Burden to a Strategic Asset

Mistakes in bookkeeping don’t just cost you hours of frustration, they cost you money, lost opportunities, tax exposure, and poor decisions. On the flip side, when you build strong habits, adopt the right tools, and partner with the right advisors, bookkeeping becomes a competitive advantage. You gain clarity, you move faster, and you lead with confidence.

If you’re ready to stop the cycle of catch-up and chaos, and instead bring clarity and control to your finances, let’s talk. At Zenbooks we’ve helped companies from startups to scale-ups unlock growth through smarter bookkeeping and modern accounting. For example:

- Menos: < $200 K ➜ $12 M+ in revenue with our financial structuring and reporting.

- Moniker Partners: $5 M ➜ $20 M in 4 years by cleaning up deferred revenue and FX.

- Somerset Health & Wellness: Eliminated document chaos and built monthly rhythm.

Book a complimentary consultation with us today and see how we can turn your bookkeeping into a strategic asset.

Colin Robinson is a Principal and co-founder at Zenbooks, where he helps entrepreneurs and non profit leaders move their finances to the cloud and turn better data into better decisions as lead CFO advisor.

Subscribe for Updates

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.