Xero vs QuickBooks(QBO) Comparison - The Battle of Cloud Accounting

Disclaimer: We have not been paid by either Quickbooks or Xero to write Xero vs Quickbooks(QBO) Comparison. We are online accountants who use these two cloud based accounting software extensively in our day-to-day operations and have opinions we’d like to share based on our thorough experience in online accounting in Canada. We’ve implemented cloud based accounting software for over 300 businesses in Canada and do not receive any kick-backs or affiliate revenue from either software.

TDLR: Xero wins! You could probably handle your small business accounting needs with either, but one may be better suited for your specific business needs. Deciding on the appropriate platform requires a bit more exploration into the needs of your business, your office workflow, and the preferences of your users. This Xero vs Quickbooks(QBO) Comparison also shows that both are fantastic tools to handle your books online and get more open API sofwtare available to you. At the moment, we are more likely to recommend Xero to most businesses, but competition is fierce and who knows what the future will bring. Bring on the upgrades!

Background

QuickBooks has dominated the North American accounting software market for ever. Everybody knows the QuickBooks name, because their desktop application has been out for years! But now, things are changing when we start looking at cloud accounting!

After bursting into the US market in 2011, Xero has managed to take a significant piece of the pie, thanks to their beautiful interface and ability to integrate with various online apps that allow you to run your business completely online. This new competition has spurred development on both platforms, which has resulted in regular updates and upgrades to enable new features and integrations to pave the way for increased automation and improved insight into the performance of your business. Great for the users, right? The questions remains – which platform is best for your business, today?

Cloud Accounting

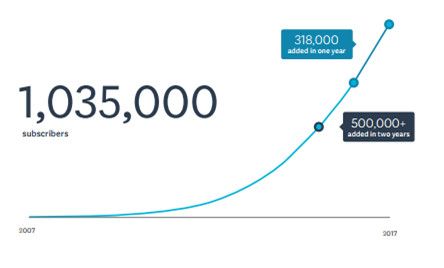

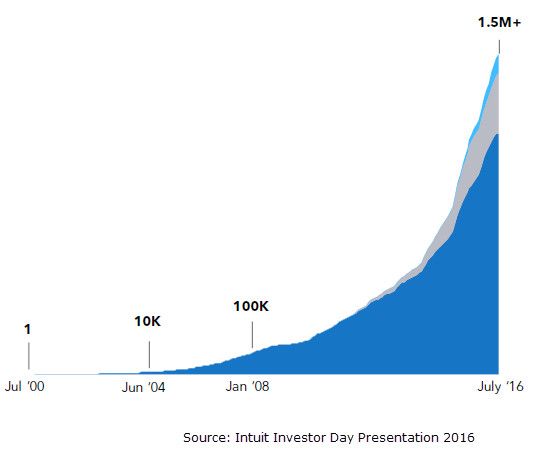

Both QuickBooks Online and Xero have experienced enormous growth in the last 10 years, it’s really astonishing! As the tight fight for market share across the international market continues, you might be thinking… “Why have I never heard of Xero, if they are gaining market share?”. The reason is that Xero is a product that was originally developed in New Zealand, and their strongest presence is in Australia, New Zealand and the UK, which count the majority of their subscribers. QuickBooks Online continues to dominate the North American market.

Xero has released an incredible amount of scheduled updates, which is really lighting a fire under QuickBooks Online’s butt! The pace of development is great news for business owners, because competition means better products for end user, and extraordinary improvements, while they fight out for market share.

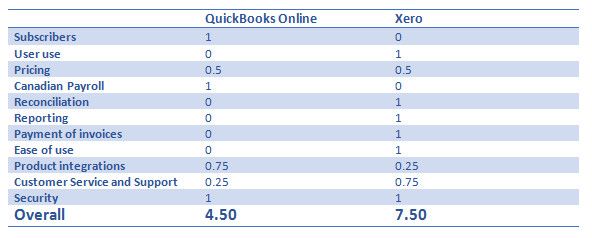

We’ve detailed out our thoughts on each important category for each software, based on our experience and our research. The chart below summarizes our findings:

Subscribers:

We review how many subscribers Xero and QuickBooks each have in this Xero vs Quickbooks(QBO) Comparison.

Xero +1M subscribers

QuickBooks Online (QBO) +2.2M subscribers

QuickBooks is currently setting the pace for growth, but also benefited from head start because of QuickBooks’ brand recognition for its desktop version. As a business owner, it’s comforting to know that your platform of choice has the subscribers and resources to continuously make improvements to their product and iron out any glitches or growing pains. The reality is that both pieces software have evolved and changed so much in the past 5 years. They have both gained about half their subscriber base in the last two years alone, so the race is far from over!

Quickbooks has more subscribers in North America. Quickbooks wins this one!

User use:

Xero allows for unlimited users, no matter which plan you get, whereas QuickBooks Online offers a tiered model which requires you to pay for additional users. Xero wins on it’s flexibility on users (Number and restrictions of users).

Pricing:

If all you need is a basic bare bone cloud accounting software, QuickBooks Online is less expensive then Xero. Hands down. But, once you get a few users involved, or need to add payroll functionality, the distinction isn’t quite as clear. While the costs are a bit higher for Xero’s Starter and Standard plans, they can include WAY more functionality than QuickBooks Online plans at that level. (For example, job costing and purchase orders are not included in QuickBooks Online “essential” plan.) Overall, we’d give the nod to QBO in this category, but it depends on the level of functionality you need.

Canadian Payroll:

QuickBooks Online has a great payroll function that allows to run Canadian payroll. With Xero, additional software (such as Wagepoint or PaymentEvolution) is necessary in order to run Canadian payroll. Wagepoint($20/pay, Plus $2/employee) is a great addition to Xero (or even QBO), and provides individualized employee portals for employees to check out the T4s, Pay Stubs and more. Quickbooks wins this comparison because it has a payroll platform built in, however the platform is not a smooth/seemless process for business owners and employees.

Reconciliation:

QuickBooks Online and Xero both offer a bank feed feature which loads all transactions from a bank or credit card directly into the software. This works great! Xero uses a third-party to get its bank feeds, while QuickBooks Online uses its own internal service. We’ve found that while there are sometimes issues importing bank feeds with either option, the service is fairly reliable but also depends heavily on your bank you use and what kind of account you have.

Categorization, Reconciliation and cash-coding – Xero is a true leader in the categorization feature which allows to quickly code transactions imported manually or through the bank feed. Xero has a more comprehensive offering for this and can help bookkeepers, accountants and business owners really gain some ground in this area. Additionally, while Quickbooks was first to release a bulk recoding feature, Xero’s more recent “Find & Recode” feature takes bulk recoding to another level. This option allows to process changes to your accounts in bulk, whether they are sales, expenses, bills, checks – any type of transaction.

“Find & Recode” and cash coding are major differentiation between QuickBooks Online and Xero. The ability to mass-categorize transactions is game changing and can save HOURS of work for your bookkeeper or accountant. We’ll see what QuickBooks will release in response next, but the “Find & Recode” feature from Xero will be tough to beat.

Xero additional Find & Recode feature and cash coding blows away the Quickbooks product. Cash coding allows hours of work to be done in minutes! Find & Recode feature has just recently been rolled out by QuickBooks in a simplified version, so time will tell if it will be as good as Xero. But for now, Xero wins on reconciliation speed and functionality.

Reporting:

Xero’s customization options for reporting are amazing, while QBO sticks closer to what you’re used to with the desktop version of QuickBooks. You’re still going to get the basics in both software (Income Statement, Balance sheet, Budget-vs-Actual, etc), but Xero provides enhanced reports and the ability to configure and save your templates to get the layout that you want. Xero wins this one because it allows you to customize reports by % of other lines and the reports come out looking very “clean”. This is a important factor in our decision to ensure ease of use and pleasant layouts from Xero.

Invoice Payments:

Both programs let your clients pay their invoice online. With QBO, you are required to use QuickBooks Payments, while Xero allows you to use third party integrations such as PayPal or Stripe to accept payment on your invoices. Xero wins – Fees can get expensive on either platform, but we’ll give the nod to Xero for allowing users to choose the payment processor that they prefer to use for collecting payments.

Ease of Use:

Xero is beautiful and incredibly easy to use. The feedback we get from non-accountants (our clients) is that there is a significantly smaller learning curve for Xero, when compared to their experience with QBO. As advisors, sometimes this is an easy thing to overlook. Xero prides themselves on being “Beautiful Accounting Software” while being easy to use and have to hand it to them, they’ve delivered a product that has been easy to implement in our office and for our clients. That said, QBO has made some significant changes to their navigation and layout, which indicates their willingness to improve their product in the eyes of potential users. The challenge for QBO is that many Accountants prefer the layout and appearance of the legacy QuickBooks product, while the consumer market is clearly looking for something a little different. Xero wins this one hands down. Xero is a absolutely easier software to use.

Product integrations: Xero wins (kind of)

One of the most amazing things about both software is their integrations with other software and application that work seamlessly. Both offer their API to developers, and help them create connections that “play nicely” between their app and either Xero or QBO.

Xero offers over 1000 integrations with other software, while QuickBooks Online offers about 750 integrations. What we should keep in mind is that, it’s not about the number of integrations but rather the quality of the integrations. Each have their own “ecosystem” of software and some software would only work with one or the other.

Xero wins this one because it has a larger quantity of integrations. however it’s hard to get a understanding of the quality of each integration.

Customer Service and Support:

This one is a funny category. QBO support used to be atrocious… But intuit has heard this complaint loud and clear! I’ve detailed the types of support available for each below:

QuickBooks:

– Phone (9AM-8PM)(EDT) Mon-Fri

– Email (24/7) (1 Day response guaranteed)

– Chat (9AM-8PM)(EDT) Mon-Fri

Xero:

– Phone – None (sort of)

– Email (24/7)

– Chat – None

While QuickBooks has phone and chat support (from 9AM-8PM), Xero actually has much better customer ratings of their customer support. Yes, you read this correctly, there’s no phone support for Xero users. While the Xero community have voiced their concerns loud and clear, Xero has indicated that if ever you need to explain something by phone you can leave your phone details and they will give you a call back ASAP. We noticed that Xero’s support responds pretty quickly. Both companies have placed an emphasis on timely and quality support, but the one product team at Xero seems to currently have the advantage. However overall the Xero support has been better rates by clients overall.

Security:

Not much of a difference here. Both have very high end security (Tier 4 data centers, SSL encryption for data transfer, offer two factor identification and regular client back-ups in multiple locations). Both are really tied here. No clear winner.

Conclusion

Xero wins! …For now. The reality is that most businesses can effectively handle their cloud accounting needs with either platform, and deciding on the appropriate platform requires a bit more exploration into the needs of your business, your office workflow, and the preferences of your users. In this Xero vs Quickbooks(QBO) Comparison both are fantastic modern tools to handle your books and take advantage of the breadth of cloud applications designed to run your business more effectively and make your life easier, particularly when tax season rolls around. At the moment, we are more likely to recommend Xero to most businesses, but competition is fierce and who knows what the future will bring. Bring on the upgrades!

Both Xero and QBO are available for a full free trial. If you or your business are looking to make the switch, or just want to chat about cloud software, please get in touch with us – we’d love to help out!

Subscribe for Updates

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.