New Opportunity - Income splitting using prescribed rate loans!

Update: April 5, 2023 at 9:57AM

Prescribed interest rates have increased significantly. CRA’s interest rate on these loans are now sitting at 5%, which means this is a horrible time for this kind of planning opportunity. We highly recommend waiting until interest rate decrease again before considering this kind of planning opportunity.

As at June 2020

Why is a prescribed rate loan now an opportunity?

The CRA sets the minimum interest rate we can use to set-up some tax planning structures. For the last several years, that interest rate (prescribed interest rate) has been 2%. That is kind of high, which makes it more difficult to find cases where a 2% interest rate loan would be beneficial to use in tax planning. The CRA sets these rates every quarter. Our contacts have discussed that the CRA prescribed interest rate is expected to decrease from 2% to 1% for Q3 of 2020. If that DOES occur, we expect a few tax planning strategies to become more viable.

Loans given out during this period will lock-in the prescribed interest rate for the term of the loan.

So, what is income splitting?

Income splitting happens when income is transferred from a high-income family member to a lower-income family member so that it is taxed in their hands at a reduced rate. This ultimately reduces the total tax bill for the family substantially.

The trick to income splitting is to split your income in a way that CRA allows should CRA audit your payroll or corporate taxes. Given the additional scrutiny that CRA has been placing on business owners with Tax On Split Income (TOSI) rules, it is even more important to make sure we justify and substantiate any income splitting strategies used by your business. One of these strategies are with prescribed rate loans, and we can help you understand what this entails.

How can this new prescribed rate help with income splitting?

There are restrictions on certain types of income received by non-active employees/shareholders to prevent income splitting. However, providing a loan to a lower-income family member is not restricted provided the prescribed interest rate is charged and the loan is paid back.

The lower-income family member can use this loan to purchase investments and even shares in a family-run corporation at fair market value. The result is the income made from these investments are taxed in the lower-income family member’s hands and not attributed back to the higher-income earner. In cases where an investment has a higher return than the cost of this prescribed interest rate, it makes sense to pursue this option.

Let us look at how this would work with the following example, a Medical Professional Corporation (MPC).

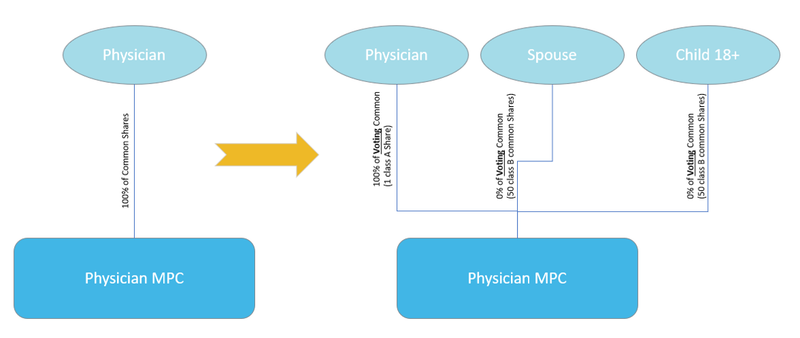

Before restructuring, this MPC’s common shares were solely owned by the physician. As such, earnings from the MPC could only be distributed to one shareholder – the physician.

By taking advantage of the new prescribed interest rate of 1%, this physician could provide a loan to his spouse and/or children to enable them to invest in non-voting shares in the MPC. In this example, should this investment earn more than a 1% rate of return, the additional income could be distributed to their spouse and/or children.

The CRA sets a few criteria that need to be followed to ensure compliance, including refinancing restrictions, loan length, repayment terms and bank transfer requirements. We invite you to connect with us if you think there may be an opportunity in this area.

Subscribe for Updates

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.