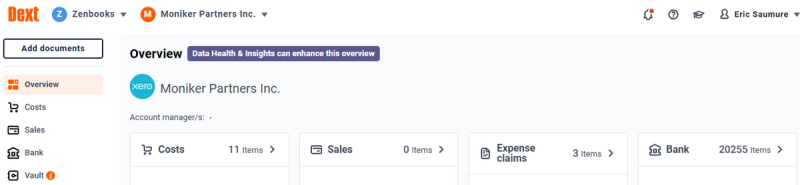

Zenbooks Case Study: Moniker Partners Corporate Travel & Retreat Planning

4 Years, 4x Revenue: The Accounting Fixes That Helped Unlock Moniker’s Full Potential

Moniker Partners is a Corporate Travel & Retreat Planning company that was doing $5M in revenue in 2021, and is now over $20M in 2025 (4 years). They were having challenges with their previous Cloud Accounting firm, who were struggling with tasks like staying on top of Accounts Receivables invoices, Foreign exchange management, deferred revenue tracking, and consistent month-end close due to past accounting missteps and ensuring we were being efficient with our taxes at year end.

The Challenge: Previous accounting firm was not delivering to agreed-upon standards

- Pain Point:

- Inaccurate or incomplete financial reporting

- Communication Gaps

- Strategic Guidance and Forecasting

- Cost Efficiency and Scalability Concerns

- Impact: Their previous accounting firm left books disorganized, failed to plan around key tax events, and frequently changed team members, eroding trust and creating financial blind spots from lack of continuity and proper training of new account managers. Given the high turnover of other firm, there was no real strategic input or financial oversight.

The Desired Outcome:

An accounting firm that could deliver on their promises, and keep up with the pace of their growing business needs

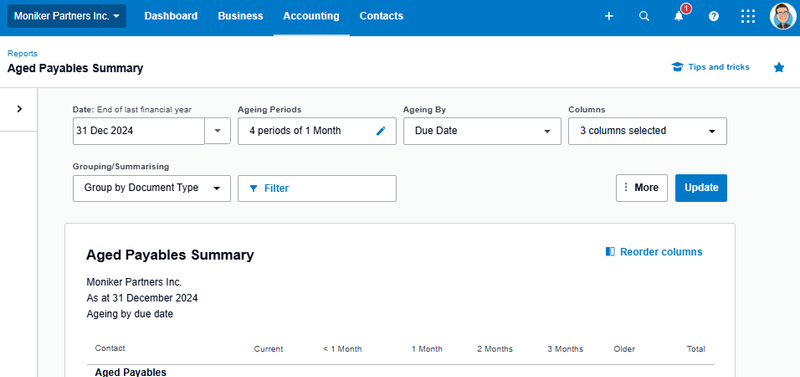

- Goal: Real-time visibility on P&L, zero late fees, accurate deferred revenue tracking, manage high volume of foreign exchange transactions(80% of transactions) and a predictable close process.

- They also needed proactive tax strategy, better cash runway insights, and relevant ratio tracking without information overload.

Wanted 100% Canadian team (no offshoring) who were experts in Canadian bookkeeping practices and tax laws.

The Solution

- Onboarding: Mapped out current workflows with Moniker team. Identified deferred revenue, bonus timing issues, and need for runway visibility.

- Ongoing Support: Monthly financial review calls with proactive advisory (e.g., HST review, tax efficiency, EHT payroll support, Bonus Planning, etc). Built balance sheet health into a recurring review process. Clear and consistent communication.

The Alternative

- A high growth company with incomplete financial reporting has a very high rate of failure because they cannot predict cashflows. Couple that with lack of communication, lack of accountability with the high turnover and this business would have had liquidity issues.

The Client Feedback

“Flawless books. On time, and error-free payroll and accounting. Always deliver on time as agreed to in our service agreement. Quick to respond when we have any questions, and very accessible”

“I appreciate their team and ownership seem to genuinely care about the work they do, and how they contribute towards their client's success. Something we lacked in our previous 2 experiences with cloud accounting firms.”

The Next Step

👉 Are these the kind of results you want? Grab a free consultation with our team and sign up now.

The Approval and Verification

Data and case study reviewed and approved by client.

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.