Budgeting & Forecasting: What Successful Businesses Do Differently

After working with hundreds of business owners, we’ve picked up on a pattern: those who budget and forecast are generally more stable, grow faster, and feel more confident about the future. They navigate uncertainty with a clear map and a reliable compass, making decisions from a position of strength, not stress. They know their numbers inside and out, which gives them the power to act decisively.

The ones who don’t often find themselves in the opposite position, perpetually caught in a cycle of reactive decision-making:

- Making major business decisions on instinct, not hard numbers. They might invest heavily in a new marketing campaign based on a "good feeling," only to find it depletes cash reserves needed for an upcoming slow season.

- Struggling with cash flow surprises they didn’t see coming. A large, unexpected bill arrives, a key client pays late, or a tax payment is larger than anticipated, and suddenly, making payroll becomes a frantic, last-minute scramble.

- Missing opportunities because they can’t measure the risk. A chance to purchase inventory at a steep discount or bid on a game-changing contract appears, but without a clear financial picture, the risk feels too great to take. They are forced to play it safe, staying small while their prepared competitors leap forward.

- Feeling a constant, low-grade anxiety about money. They lie awake at night wondering if they have enough to cover next month's expenses, a feeling that erodes their focus and passion for the business itself.

We created this resource to help you reclaim control of your numbers, move from reacting to planning, and start making the confident, data-driven decisions that define successful businesses. This is your guide to preparing for what’s ahead and building a more resilient, profitable, and predictable company.

Budgets & Forecasts: What They Are, What They Aren’t & Why They Matter

Many business owners tell us they “have a budget.” When we dig a little deeper, what they really mean is they have a spreadsheet, often built for a loan application or a business plan, that gets updated once a year, if at all. It sits in a folder, a static snapshot of a moment in time, while the business itself continues to change and evolve every single day.

That’s not a budget. And it’s definitely not a forecast. It's a historical document, not a living tool.

Think of it this way: a budget is your detailed road map for a journey. A forecast is the real-time weather report and traffic update. You wouldn't start a cross-country drive with just a map from last year, ignoring road closures, storms, or traffic jams. You need both to reach your destination efficiently and safely.

A budget is an operational plan that shows how you’ll allocate finite resources (like time, money, and people) to achieve your strategic priorities. It’s a statement of intent, grounded in your goals. It should answer critical, present-tense questions like:

- Can I cover payroll, rent, and all other fixed costs if sales dip by 20% next month?

- What should I adjust in our spending if material costs or shipping rates continue to rise?

- Based on our current profit margins, do I have enough resources to reinvest in growth initiatives like new technology or marketing?

- Are we spending in a way that truly aligns with our most important goals for the year?

A forecast, on the other hand, is your projection of future financial performance. It’s a dynamic tool, built on real historical data but continuously updated as market conditions, sales pipelines, and internal operations change. Why? Because what’s true this quarter might not be true the next. A solid forecast is about anticipation and preparation. It should answer forward-looking, "what-if" questions like:

- If we land that large new contract, can we afford to hire the two additional people needed to service it, and when should we start the hiring process?

- If a recession causes our revenue to slow by 15% over the next six months, how long can we keep things running at full capacity before we need to make cuts?

- If our key supplier raises prices by 10% unexpectedly, what adjustments will we need to make to our pricing or other expenses to protect our margins?

- Based on our projected cash flow, when is the optimal time to make a major capital investment, like purchasing new equipment or upgrading our software?

In simple terms, the budget keeps your daily spending and long-term strategy aligned. It’s your rulebook. The forecast ensures you are ready to adjust to changing conditions before challenges become crises, not after. It’s your early-warning system. One without the other gives you an incomplete picture, leaving you vulnerable to the very surprises you’re trying to avoid.

The Risks of Operating Without a Budget or Forecast

Many business owners skip budgeting and forecasting, and the reasons are often understandable. It can feel time-consuming, intimidating, or like something only "bigger" companies with dedicated finance teams need to do. Some feel their business is too unpredictable to plan, while others simply prefer to focus on sales and operations, the parts of the business they love.

The truth? Budgeting and forecasting are not administrative burdens; they are critical strategic tools for businesses at every growth stage and size. They are the foundation of financial discipline and intentional growth. And operating without them isn't liberating, it's incredibly risky. You're essentially flying a plane through the fog with no instruments, hoping you're headed in the right direction.

Here are the specific, tangible risks you take on:

1. Running Blind Without a budget or forecast, your decisions are based on gut feelings, anecdotal evidence, or a quick glance at the bank balance. This leaves you with no real sense of where the business truly stands. You might feel successful because revenue is high, but without tracking your margins, you could be losing money on every sale. You might invest in a marketing channel that feels busy but delivers a poor return on investment. You're making choices in a vacuum, unable to distinguish between a smart risk and a reckless gamble.

2. Crippling Cash Flow Crunches This is the most common and dangerous risk. Cash flow is the lifeblood of a business, and managing it poorly is a fast track to failure. Without a forecast, you can’t see the timing mismatches between when money comes in and when it goes out. Overspending during a good month or poor timing of a large purchase can leave you scrambling when big bills and payroll are due before that big client payment has landed in your account. This leads to a domino effect of bounced payments, late fees, damaged supplier relationships, and the immense stress of finding emergency funds.

3. Insurmountable Financing Roadblocks Sooner or later, most businesses need external capital to grow, whether it’s a line of credit from a bank, a loan for new equipment, or investment from angels or VCs. The very first thing these capital providers will ask for is your financial projections. They want to see a well-reasoned forecast that demonstrates you understand your business's economics and have a credible plan for the future. If you can’t produce one, or if what you provide is clearly just guesswork, their confidence plummets. Your funding options shrink, and you may be forced to accept unfavorable terms, if you can get funded at all.

4. Missed Growth Opportunities Growth isn't just about ambition; it's about preparation. Opportunities often arrive with a tight deadline. Your biggest competitor’s key salesperson becomes available. A chance to acquire a smaller rival arises. A new distribution channel opens up. Without a solid financial model, these opportunities slip away, not because you lack vision, but because you're forced to make reactive decisions. You can't confidently answer the crucial questions: "Can we afford this?" and "What is the expected return?" You hesitate, and the window closes.

5. Strategic Drift and Wasted Resources A budget forces you to be intentional about where every dollar goes. Without one, spending becomes haphazard. Money trickles away on subscriptions that are no longer used, inefficient processes, or projects that aren't aligned with your primary goals. You might be overspending on one department while underfunding another that could drive significant growth. This lack of financial discipline leads to strategic drift, where the business meanders without a clear direction, wasting its most precious resources along the way.

Building a Budget That Works in the Real World

Anyone can drop numbers into a spreadsheet template and call it a “budget.” Unfortunately, a budget created that way is little more than a financial exercise. It won’t help you make informed decisions, and it will likely be ignored within weeks.

A truly effective budget is a living document, a strategic tool that reflects your reality and guides your choices. Here’s how to create a budget that actually works:

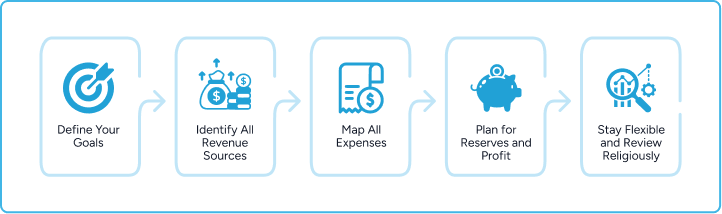

1. Define Your Goals: The "Why" Behind the Numbers Before you type a single number, you must define what success looks like for the upcoming period (usually a year). A budget without goals is just a list of expenses. Your primary goal should shape every allocation decision. Are you focused on:

- Aggressive Growth? Your budget might prioritize sales and marketing spend, R&D, and hiring new talent, even at the expense of short-term profitability.

- Maximizing Profitability? Your focus will be on operational efficiency, improving gross margins, and tightly controlling overhead.

- Stability and Resilience? You might prioritize building a substantial cash reserve, paying down debt, and investing in systems that reduce risk.

"The first thing I ask when a client wants help with their budget is 'what are you trying to accomplish this year?'" says Eric Saumure, Principal, CPA, CA at Zenbooks. "If they say 'I just want to track my spending,' we've already missed the point. A budget should be a tool that helps you get somewhere specific, not just a rearview mirror."

Make these goals specific and measurable using the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound). For example, instead of "grow the business," a goal might be "Increase annual recurring revenue by 30% by the end of Q4" or "Improve gross profit margin from 45% to 50% within six months."

2. Identify All Revenue Sources: The Top Line Start with the money coming in. Pull your historical sales data from the last 12-24 months. Don't just look at the total; break it down. Include every single stream of income, from your core products or services to seasonal spikes, side projects, or interest income. Ask yourself:

- Is our revenue consistent month-to-month, or is it seasonal?

- Do we rely on a few large clients or many small ones?

- What is the revenue mix between different products or service lines?

- Are there any new revenue streams we plan to launch this year?

Project your revenue for the coming year based on this historical data, but layer in your strategic goals. If you plan to increase marketing spend, how will that translate to sales? If you're raising prices, how might that affect customer volume?

3. Map All Expenses: Understanding Cash Outflow This is where the real work begins. To get a realistic picture of your cash outflow, you must meticulously categorize every single business expense. The most critical step is to separate them into three main categories:

- Fixed Costs: These are the expenses that stay roughly the same every month, regardless of your sales volume. Think of them as the cost of keeping the lights on. Examples include rent, insurance, salaried employee payroll, loan payments, and key software subscriptions (like your accounting platform).

- Variable Costs: These expenses fluctuate in direct proportion to your sales or production volume. As you sell more, these costs go up. This category often includes Cost of Goods Sold (COGS), the direct costs of creating your product (raw materials, direct labor), as well as sales commissions, shipping fees, and payment processing fees.

- Semi-Variable Costs (or Step Costs): These are hybrid costs that may be fixed for a certain level of activity but then increase once a threshold is passed. For example, your utility bills have a fixed base rate but increase with more production. Or, you might need to hire another customer service representative (a "step" up in cost) once you hit a certain number of clients.

Mapping expenses this way is powerful. It shows you your baseline cost structure (fixed costs) and helps you understand your true profitability on each sale (revenue minus variable costs).

4. Plan for Reserves and Profit: Pay Yourself First A common mistake is treating profit as whatever is "left over" at the end of the month. A powerful budget flips this on its head. After projecting revenue and subtracting your essential variable and fixed costs, the very next line items should be allocations for a cash reserve and for profit.

- Cash Reserve: Set aside a buffer for the unexpected. The standard rule of thumb is to hold 3-6 months of fixed operating expenses in an easily accessible savings account. This fund is your shield against market dips, equipment failure, a key employee quitting, or a global pandemic. It's not for investment; it's for survival.

- Profit: Intentionally allocate a percentage of revenue to profit. This ensures the business is rewarding its owners and building long-term value, not just surviving month to month.

5. Stay Flexible and Review Religiously The biggest failure of traditional budgeting is that it's treated as a one-time event. Your business is dynamic, and your budget must be too. Schedule a recurring monthly or quarterly meeting to conduct a "budget vs. actual" review. This is where you compare your planned numbers to your real-world results.

- Where did we overspend? Why?

- Where did we underspend? Is that a good thing (efficiency) or a bad thing (underinvesting in a key area)?

- Was our revenue projection accurate? If not, what changed?

This regular review process transforms the budget from a rigid document into an agile management tool. It allows you to make small course corrections throughout the year, so it always reflects your current financial reality, not last quarter’s outdated assumptions.

What a Strong Budget Delivers A strong budget isn’t just a dry record of income and expenses; it’s an active management tool that fundamentally shapes how you run your business. When done right, it delivers more:

- Clarity: It provides an honest, black-and-white answer to the question, "Is the business living within its means?" It replaces ambiguity with certainty.

- Efficiency: By categorizing every dollar of spending, it immediately highlights waste, redundant subscriptions, and inefficient processes, allowing you to redirect that cash toward initiatives that actually drive growth.

- Foresight: It helps you anticipate and plan for large, recurring costs like insurance renewals, tax payments, or annual software licenses so you’re never caught off guard.

- Alignment: It acts as a powerful communication tool, ensuring that the daily spending decisions made by you and your team are always tied directly to your most important long-term goals.

- Accountability: It creates a benchmark against which you can measure performance, holding yourself and your team accountable for hitting financial targets.

Building a Forecast That Drives Proactive Decisions

If a budget is your plan for today, a forecast extends that plan into the future. It's less about rigid control and more about strategic visibility. While a budget asks, "Are we on track?", a forecast asks, "Where are we headed, and what might get in our way?" Forecasts help you prepare for what’s ahead instead of reacting after it happens, turning uncertainty from a threat into a manageable variable.

Types of Forecasts Forecasting isn't a one-size-fits-all activity. Different forecasts answer different questions and serve different purposes. The most critical types for a growing business include:

- Sales Forecast: This is the foundation of all other forecasts. It projects future revenue based on historical data, the current sales pipeline, market trends, and marketing initiatives.

- Cash Flow Forecast: Perhaps the single most important forecast for survival, this projects the timing of all cash inflows and outflows over a period, typically on a weekly or monthly basis. Its goal is to identify potential cash shortages before they happen, giving you time to act.

- Profit & Loss (P&L) Forecast: This projects your company’s overall profitability by forecasting revenues and all associated expenses over a period, showing you whether your business model is sustainable and on track to hit its profit targets.

Forecasting Horizons and Approaches Within these types, you can also vary the time frame and assumptions:

- Short-term forecasts (30-90 days): These are tactical and focus heavily on cash flow planning and day-to-day operational decisions, like managing inventory or scheduling staff.

- Long-term forecasts (1-3 years): These are strategic and used for planning major investments, securing financing, evaluating expansion opportunities, or setting long-term growth targets.

- Conservative vs. Aggressive Scenarios: A conservative forecast might understate potential revenue and overstate likely costs to create a "worst-case" view. An aggressive forecast builds in optimistic "best-case" scenarios. The most effective approach is to create and maintain three versions: conservative, aggressive, and realistic (most likely). This gives you a clear view of your potential upside and downside risk.

How to Create a Meaningful Forecast

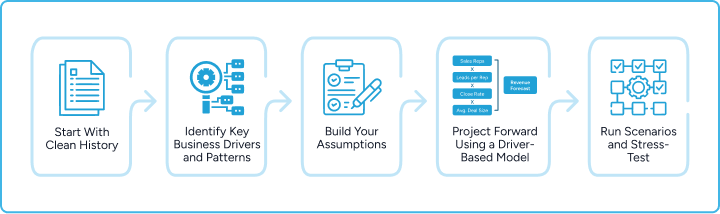

- Start with Clean History: A forecast is only as reliable as the data it's built on. Begin by gathering at least 12-24 months of clean, accurate financial statements (P&L, Balance Sheet, Cash Flow Statement). This historical data is your baseline.

- Identify Key Business Drivers and Patterns: Don't just look at the final numbers. Dig deeper to understand what drives them. Identify seasonality in your sales cycle, recurring costs that spike at certain times of the year, and historical growth trends. Also, consider external factors like economic indicators, industry trends, and competitive actions.

- Build Your Assumptions: This is the most critical step. A forecast is essentially a set of assumptions about the future. Document them clearly. Examples include: "We assume a 5% increase in material costs in Q3," or "We assume our conversion rate from the new marketing campaign will be 2%," or "We assume a 10% customer churn rate per year."

- Project Forward Using a Driver-Based Model: Instead of just adding 10% to last year's sales, build a driver-based model. For example, your revenue forecast might be a formula like: (Number of Sales Reps) x (Leads per Rep) x (Close Rate) x (Average Deal Size). This is far more powerful because you can now see how changing one driver (like improving the close rate) will impact the entire forecast.

- Run Scenarios and Stress-Test: Use your model to answer "what-if" questions. What happens to our cash flow if our biggest client leaves? How does a 20% increase in ad spend affect profitability? If we hire three new developers, when do we break even on that investment? This scenario planning is what prepares you for virtually any eventuality and turns your forecast into an indispensable strategic tool.

What a Strong Forecast Delivers A strong forecast doesn’t just project numbers; it gives you the strategic insight and operational confidence to:

- Hire with Confidence: Know precisely when the business can safely afford to bring on new staff or contractors, moving from a gut-feel decision to a data-backed one.

- Grow Deliberately: Identify the right time to make significant investments like expanding locations, launching new services, or adding products, ensuring you have the cash flow to support the growth.

- Protect Your Cash Flow: Get an early warning when you might need to tighten spending, accelerate collections from customers, or secure a line of credit before problems hit.

- Gain Credibility with Stakeholders: Back up your growth story with clear, logical, and well-supported numbers that give investors and lenders the confidence they need to bet on you.

- Make Faster, Better Decisions: When faced with a challenge or opportunity, you can quickly model the financial impact of your choices, allowing you to act with speed and precision.

Discuss your needs and learn about our solutions through a complimentary consultation.

(833) 936-5433The Zenbooks Approach to Budgeting & Forecasting

Creating budgets and forecasts that actually guide decisions can feel overwhelming for a busy owner. It's easy to get lost in the spreadsheets or build a model based on faulty assumptions. That’s where we come in. At Zenbooks, we pair simple, powerful cloud tools with hands-on, expert advice to make the process clear, useful, and transformative for your business.

Here’s how our process works:

Reviewing Your Finances & Goals

We start with a deep dive into your business. We don't just look at your past financials; we seek to understand your business model, your competitive landscape, your operational processes, and, most importantly, your priorities as an owner. This ensures the financial plan we build reflects the unique reality of your business instead of forcing you into a generic template.

Building Budgets & Forecasts

Guesswork has no place in financial planning. We work with you to build a dynamic financial model, not a static spreadsheet. We test different scenarios collaboratively. You’ll see exactly how decisions like adding staff, launching a new product, or opening a new location will affect your cash flow, profitability, and valuation before you commit a single dollar.

Setting Up Cloud Systems

Spreadsheets get messy, outdated, and prone to error, fast. We implement and manage a suite of modern cloud tools that give you real-time, 24/7 visibility into cash flow, expenses, and performance against your budget, all in one place. This creates a single source of truth and automates much of the data collection, freeing you up to focus on strategy.

Providing Regular Check-Ins

Your business changes throughout the year, and so should your financial plan. A forecast is useless if it's not regularly updated and reviewed. We schedule regular check-ins to perform variance analysis (comparing your budget to your actuals), discuss what the numbers are telling us, update your forecast with new information, and help you make proactive adjustments to stay on track. This transforms bookkeeping from a historical chore into a forward-looking advisory partnership.

Who We Serve

While we’re equipped to support businesses in almost any industry, we specialize in a few where the nuances of budgeting and forecasting make the biggest impact. Here’s how we help:

E-Commerce

Is inventory tying up all your cash? Are you struggling to balance marketing spend with customer lifetime value (LTV)? Are seasonal sales leaving you with more questions than answers about cash flow? We build forecasts that align inventory purchases with sales demand and marketing spend with projected ROI, so you stay stocked and grow profitably without draining your resources.

Professional Services

Do client projects ebb and flow while your salaried payroll stays the same? Is it difficult to predict revenue when your sales pipeline is lumpy? We create budgets that manage your utilization rates and forecasts that help you plan for steady staffing without overextending your finances during slower periods, ensuring project profitability and stable cash flow.

Non-Profits

Does restricted grant funding arrive in large cycles while your program costs run year-round? Do you need to demonstrate flawless financial stewardship to your board and funders? We help you build budgets that stretch dollars across the entire fiscal year and create clear, compelling reports that keep funders confident in your mission and your management.

SaaS

Do customer cancellations (churn) or delayed renewals throw off your projections for steady monthly recurring revenue (MRR)? Is your customer acquisition cost (CAC) sustainable? We build sophisticated forecasts that factor in key SaaS metrics like churn, expansion revenue, and LTV, so you can plan hiring, R&D, and marketing expenses with far fewer surprises.

Marketing & Creative Agencies

Do unpredictable project-based revenues make it hard to cover your fixed overhead like rent and salaries? Is scope creep eating into your margins? We design budgets that keep your core operations covered and build forecasts based on your sales pipeline, helping you see when it’s safe to hire your next designer or invest in new business development.

Financial Clarity Starts Here

Most owners come to us feeling uncertain about cash flow and growth. And they stay because we give them clarity, control, and confidence. Ready to make that shift?