What if we didn’t file our taxes anymore?

The Canada Revenue Agency says they have one of the highest voluntary tax compliance rates in the world. How “voluntary” is it when you go to jail if you don’t comply?

What if Canadians didn’t need to file their taxes anymore?

Every year, Canadians go through the ritual of pretending to know the convoluted Income Tax Act, while hoping the CRA doesn’t ask them questions about their homework, due on April 30th (for most).

The dirty little truth is that Canadians don’t read the Income Tax Act, and they never will but they’re expected to file accordingly, as though they have. Most Canadians have a simple tax filing and want to file honestly with no bad intentions. But TurboTax and H&R Block suggest you’re missing out on valuable tax deductions unless you use their software. There is a large industry around personal taxes and to some extent my accounting firm, Zenbooks, also profits.

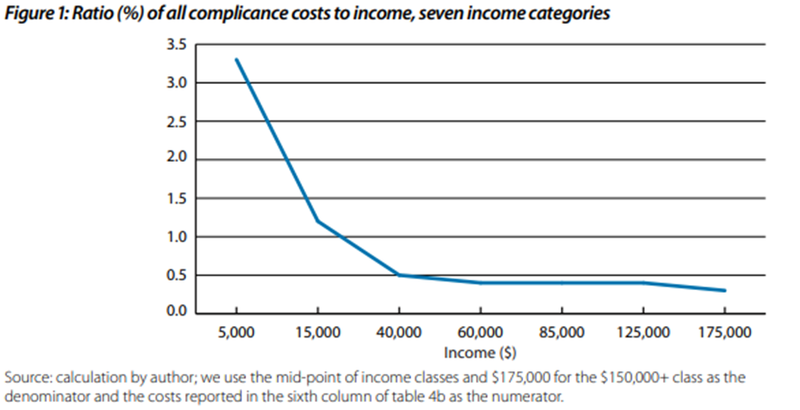

Canadians are so anxious about filing their taxes that they don’t do it themselves (only deviants attempt doing their own taxes). They spend roughly $7 Billion yearly complying with the personal tax system with as much as 69% outsourcing their personal taxes. The average cost to Canadians was $216.53, which disproportionally impacts low-income Canadians.

Ratio (%) of all compliance costs to income

After all that, the average refund in 2022 was $2,093. However, the CRA lets you know (with penalties and interest) if you’ve made a mistake.

If the CRA knows you’ve made a mistake, why do we prepare it in the first place? Canadians are being stress tested economically and emotionally.

In Canada, the Income Tax Act is written with lots of specific credits and deductions for unique situations. H&R Block spends $2M-$4M per year on lobbying efforts to stay relevant. In reality, CRA cannot easily know your home office expenses or if you qualify for the Canada Caregiver Credit. Given the government’s track record of implementing large projects (i.e. Phoenix pay system), many people wouldn’t trust the government’s reliability of accurate tax returns.

Most Canadians would benefit from having their return auto-filed because most Canadians have simple tax returns (T4s, RRSPs and Donations).

Simple tax returns are not even fun for accountants – they want a professional challenge. They’re already overloaded during tax season, there’s no need to give them easy returns. They should be focusing their energy/time on the complicated returns and easier returns should be auto-filed.

Everything else in our lives is interconnected. Political parties track us down 10 years after donating, why can’t the CRA figure this out? The CRA has records of our salary, RRSP, tuition, OAS, etc. With a few new slips (Donations from charities and rent receipts) this would cover most information the CRA needs, so people would not have to gather everything to file their taxes.

There are 36 countries that do this. It’s called “return-free” filing – Canada is lagging. Sweden, Finland and Denmark just send you a text message to file your taxes. You review and make changes (if needed). The recent vacant unit tax declarations have been relatively smooth. Canada can auto-file their returns too this way, so Canadians don’t need to.

It’s easier for government officials to add more legislation and add more filing requirements, but it’s harder for them to remove compliance burden, which makes people’s lives easier.

The CRA wants to modernize its compliance efforts, and this would help. If personal tax compliance costs Canadians $7 Billion yearly, then if a return-free system costs Canadian taxpayers less than $7 Billion, we will have recouped its costs in just a single year by auto-filing the returns.

The CRA can still audit returns. With additional slips around donations and rent, the CRA will have additional information to ensure Canadians are filing correctly.

This is a clear way to simplify Canadians’ lives and reduce their compliance burden. If we create a return-free filing, our “voluntary” compliance rate will go up. It’s a win-win-win if Canadians don’t file their tax returns anymore.

Full disclosure: TurboTax is owned by Intuit. Zenbooks works closely with QuickBooks Online (an Intuit Product).

Eric Saumure, CPA, CA, is a Principal here at Zenbooks. With experience at KPMG and over a decade partnering with business owners and executive teams, Eric focuses on financial strategy, succession planning, and operational efficiency. He’s often invited to share insights at industry events and in the media.

Subscribe for Updates

Business Clarity That Helps You Breathe Easy

Achieve your business goals and peace of mind with Zenbooks. As both your finance team and business advisor, we empower you every step of the way.