Better than a single full-time staff

ZENBOOKS IS YOUR ONLINE ACCOUNTING DEPARTMENT

Zenbooks offers online accounting services to streamline your day to day operations and allow your business to scale and operate without physical restrictions of being in an office.

We help you make key operational decisions for YOUR business. We can act as your strategic partner as your business grows and expands, or we can simply help you maintain compliance, it’s up to you!

HOW ZENBOOKS Online Accounting GROWS WITH YOUR BUSINESS

As a business grows, its accounting needs change from a compliance to a proactive approach. Without investing in an accounting department that gathers key insights, a business’ growth will be limited. This is why Zenbooks offers the following online accounting services to help you continually meet your needs as you grow:

- Dynamic Forecasting

- KPI Monitoring

- Cash Reserve Discussions

- Strategic Tax Planning

- Regular Meetings

- Strategic Input

- Utilization Ratios

- Corporate Taxes

- Realization Ratios

- Profitability by Project

- Handling of Accounts Payable

- Personal Taxes

Zenbooks is not your typical accountant, we're an extension of your team!

ONLINE ACCOUNTING

CASE STUDY

Learn how moving to cloud accounting services helped the Canadian Society of Respiratory Therapists breathe easier.

WHAT OUR CLIENTS HAVE TO SAY

Dr. Dave Neilipovitz

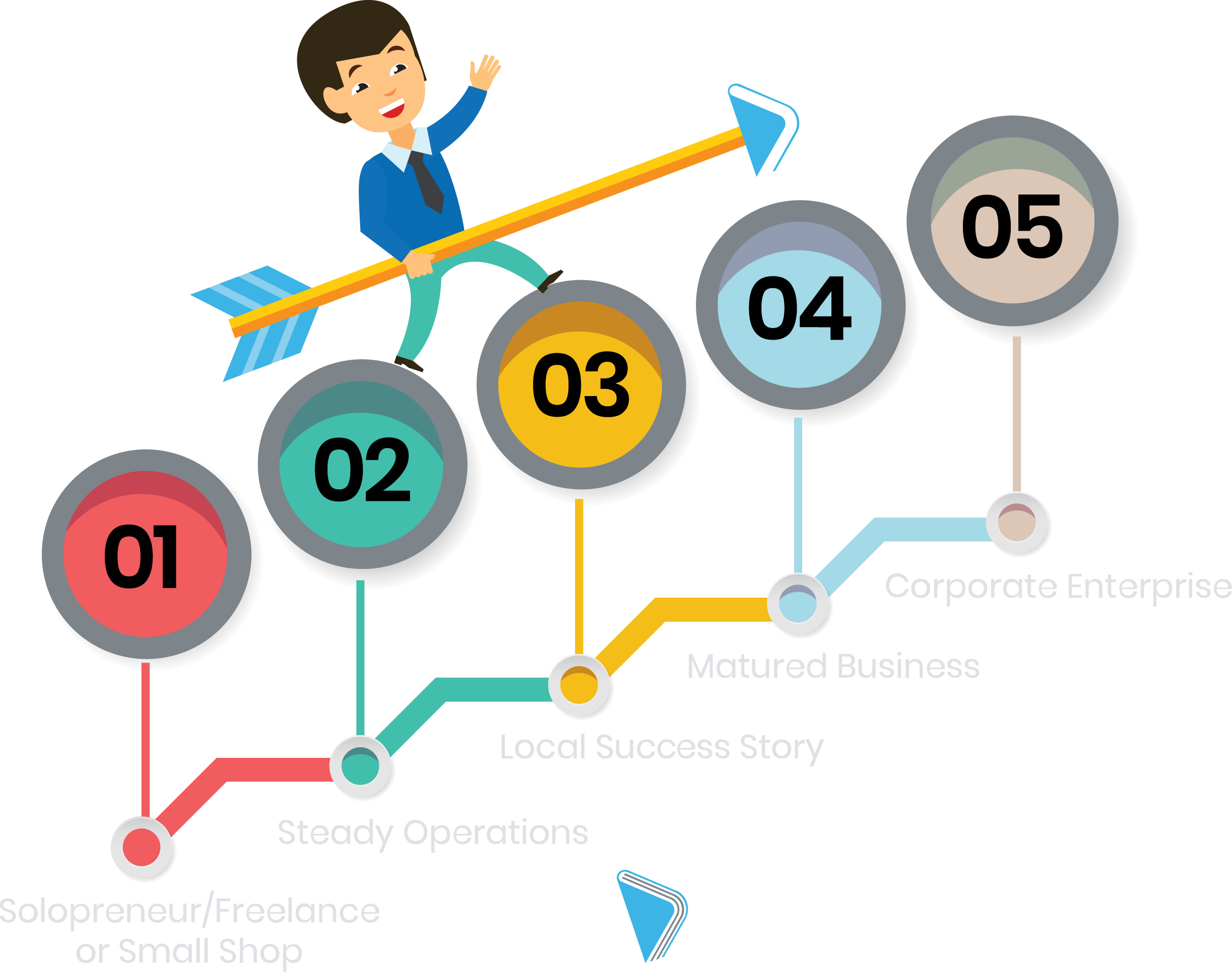

STEPS OF BUSINESS GROWTH

When you’re in between just starting out, and a large corporate enterprise, Zenbooks’s cloud accounting services is the right solution to give your business the boost in deserves.

Steps of Business Owners Progression

Stage 1 - Solopreneur/freelance or Small Shop

Traditional cloud-based bookkeeping is very typical at this stage. Essentially you want to be compliant with any Canada Revenue Agency(CRA) requirements and want an idea of how much money you’re making or losing.

Stage 2 - Steady Operations

At this point, we may need to pay 2-3 staff at your shop. Your business has grown, and we start doing some strategic planning exercises. You want to make sure you have a solid foundation of systems in place to make sure you can scale with ease. Here we’re taking care of your compliance and reporting and updating your financials more frequently.

Stage 3 - Local Success Story, Managed Organization

Here you benefit from our strategic planning on a regular basis. We establish your Key Performance Indicators (KPI) that we track on a regular basis. We’re looking at your cashflow regularly to see how any cash short or cash rich months and establishing cash reserve guidelines. We’re looking at your profitability by 1) jobs and 2) Departments. We look at realization ratios and utilization ratios to make your operations thrive.

Stage 4 - Mature Company

You need daily strategic advice on various aspects (expansions, cross-border planning, employee profit sharing plans, union negotiation, issues management, etc). As a corporate enterprise, our processes and metric are no longer a good fit. A full-time CFO would be required at this stage.

Stage 5 - Corporate Enterprise

You need daily strategic advice on various aspects (expansions, cross-border planning, employee profit sharing plans, union negotiation, issues management, etc). As a corporate enterprise, our processes and metric are no longer a good fit. A full-time CFO would be required at this stage.